United Health Group - Fundamental Charts

A look at the money behind the health insurance CEO that was shot

When people actually threaten the power structure, it doesn’t recieve widespread media attention. Your “alternative” media sources only talk about what the super villains want them to. The idea that this event is the one exception, that shooting a millionaire, not a billionaire, not even the CEO of the whole company, or the chairman of the board, is some sort of symptom of grassroots outrage, a man against the system, is naive. The company paid this man millions of dollars per year, yet when it was time to find his killer neither the company nor his own family offered up any money whatsoever, with the NYPD and FBI offering a measely $10k and $50k respectively. The man that was arrested had so much evidence on him, the only thing missing was a written confession. Oh wait, he had a handwritten “manifesto” on him. As if someone that grew up in the internet age would hand write a manifesto. There is an agenda being pushed that will reveal itself in an obvious and ineloquent fashion. And the masses of morons who only have their internet tv shows to tell them reality, who have no willpower to do any research of their own, will carry water for the super villains as they always have. Here however, we will begin by looking at the numbers.

So how much money does UNH have?

United Health has about a $100 billion in retained earnings ($96.5), with about $30b in cash and about $55b in long term assets (+/- $5b for both). And as you can see, this has been steadily increasing over the last 15 years.

And how much money do they have relative to the price of their shares?

Over $400 per share is future value, or about four times their currently retained earnings.

So if 80% of their price is money they are expected to make, how much do they actually make?

So as we can see, their net income over the previous twelve months has been about $15b compared to the ~$400b gap between their price and retained earnings. More importantly, we see a steep dropoff.

By looking at the quarterly chart, we can see that this drop off came from a single outlying quarter in which the company actually lost money, the only time this has happened in the last 15 years.

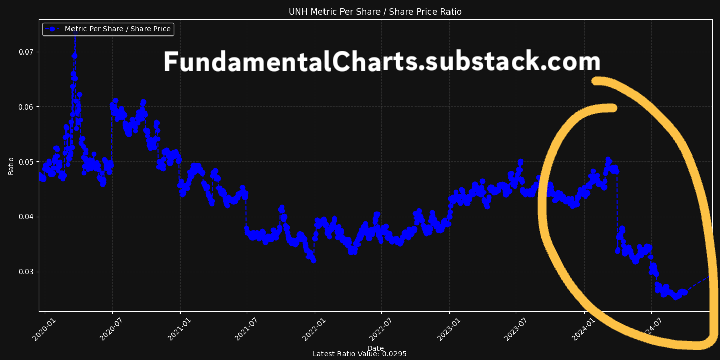

So what does the market think about that negative quarter and its effects on future profits?

[Math: TTM Net Income / Market Cap]

This chart shows that growth expectations are at a 15 year high.

(Explanation: this chart shows what % of the share price is represented by the company’s profits. The higher the market expects future profits to be, the more it is willing to pay for those profits. This results in the market being willing to accept a lower and lower percentage of current returns, with the expectation that growth will raise that return over time.)

And here’s a closeup showing that throughout this year, despite the negative quarter, the market is willing to pay more for less, implying that the market expects the company to grow faster than ever.

Let’s look at what the company’s own explanation is:

“On February 6, 2024, the Company completed the sale of its Brazil operations. During the three months ended March 31, 2024, the Company recorded a loss of $7.1 billion within the Consolidated Statement of Operations, of which $4.1 billion related to the impact of cumulative foreign currency translation losses previously included in accumulated other comprehensive loss.”

So they sold something at a loss and it’s the loss on their assets that they are reporting. Doesn’t seem like a big deal.

What’s more interesting is that this is the same exact quarter that the company lost money to a massive hack, or cybersecurity attack as they like to term it. According to reports a $22m ransom was paid. The company however reported a $680m loss for the event ($0.74 a share x 920m shares).

According to the following article, the hackers used the name of a previous group, declared a special announcement that they had a new policy about attacking health insurance companies, and shut down immediately after the attack (allegedly pretending that their website had been seized by the FBI).

https://krebsonsecurity.com/2024/03/blackcat-ransomware-group-implodes-after-apparent-22m-ransom-payment-by-change-healthcare/

So we have a multi billion dollar company that had a negative quarter for the first time in 15 years. They lose half a billion to a cyber attack with a less than twenty-five million dollar bounty. The hacking group dissolves immediately afterwards. Later that year, a CEO is shot on camera, the video is posted all over the news, and a bag of monopoly money is intentionally left behind. The company shows no fear, anger, or concern in reaction to the event other than to wish the family well. It offers no money to find whoever killed a guy they thought was worth millions. And the market has been pricing in faster future growth than in all of the company’s history. Yeah. Makes sense.

To catch our next report on UNH, subscribe and you’ll be placed on our mailing list.

Good analysis. All is spot on. You sound homeless.

Interesting points about the UHC's finances but your argument doesnt have any real bones to it. Ultimately, the thesis all depends on insinuation and intuitive thinking which can only lead to self deception and conspiratorial wish casting.