MSTR - The 100 Billion Dollar Bitcoin Stock - Does the money match the hype?

Upon request, we will be covering MicroStrategy, a company with a ~98 billion dollar market cap at the time of this write up that has been buying billions of dollars worth of Bitcoin. We will be focusing as always on value not price. Something that is constantly discouraged and desperately needed in this game of power and lies.

So first of all, what is this company. We’ve never heard of it, nor have we ever had any interest in finding out.

From its last 10k:

“MicroStrategy® recently announced that it considers itself the world’s first Bitcoin development company.”

Great. Already sounds like bullshit.

“We are a publicly-traded operating company committed to the continued development of the Bitcoin network through our activities in the financial markets, advocacy and technology innovation. As an operating business, we are able to use cash flows as well as proceeds from equity and debt financings to accumulate bitcoin, which serves as our primary treasury reserve asset. We also develop and provide industry-leading AI-powered enterprise analytics software that promotes our vision of Intelligence Everywhere™, and are using our software development capabilities to develop bitcoin applications. Our software business, which we have operated for over 30 years, is our predominant operational focus, providing cash flows and enabling us to pursue our bitcoin strategy. We believe that the combination of our operating structure, bitcoin strategy and focus on technology innovation differentiates us in the digital assets industry.”

So they are a software company that stores its retained earnings in bitcoin? We hope we have that correctly. Well what is their software and how much money does it make?

Going off their website, they appear to sell analytics software. They do a terrible job of communicating the value proposition that they offer. I’m guessing they aren’t relying on their website for custimer acquisition.

Well, our opinion doesn’t matter. How much money do they actually make?

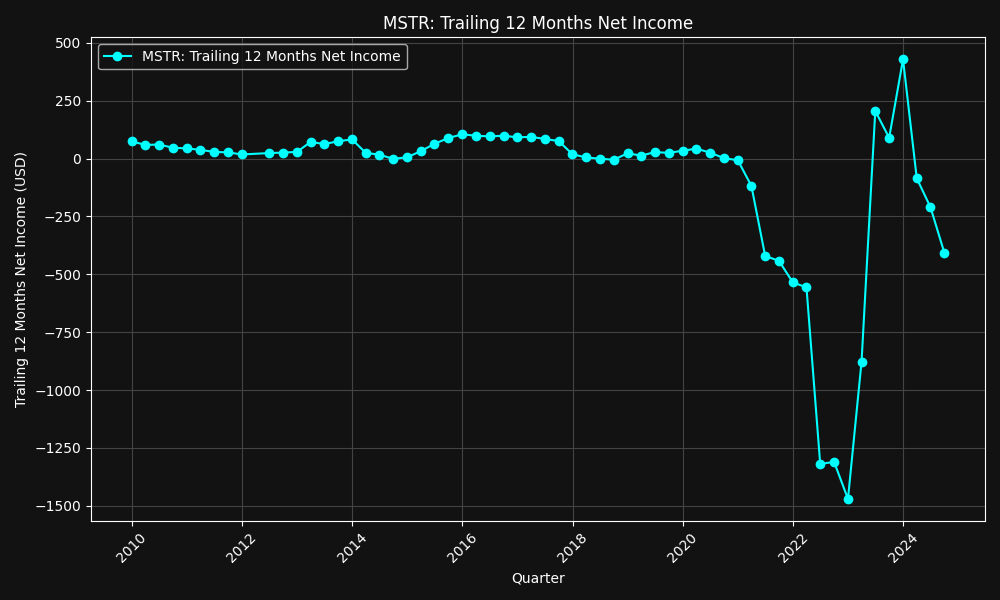

Decreasing revenue and negative profits. Fantastic. So where the fuck are they going to get the money to buy bitcoin?

Don’t tell us they are just borrowing it…

But they have to be, because this software company is not making billions of dollars in excess cash to make the purchases they’ve been making. They could be borrowing the money from outside of shareholders through the issuance of bonds or a direct loan, or from the shareholders through the selling of new shares, or some combination thereof (which a quick look at their cahsflows reveals is the case).

Ok, so you don’t care about the actual business. You’re here for the Bitcoin. So let’s look at that.

From one of the company’s recent filings: “As of December 8, 2024, the Company, together with its subsidiaries, held an aggregate of approximately 423,650 bitcoins, which were acquired at an aggregate purchase price of approximately $25.6 billion and an average purchase price of approximately $60,324 per bitcoin, inclusive of fees and expenses.”

423,650 bitcoins * $100,000 = $42,365,000,000

or $42 billion

So you’re paying over $200,000 per bitcoin at this point if you’re only buying the stock for its bitcoin and not its failing business. Did we say failing? Sorry, we meant thriving. Absolutely thriving AI business that makes no money and brings in less and less revenue.

I mean honestly. What more do you want us to say? Good luck with your $200k bitcoin purchase?