Marijuana and Dividends (IIPR)

A look at Innovative Industrial Properties, a stock that lends money to U.S. cannabis companies and pays their investors

We live in the age of marijuana’s resurgence. As the earliest companies establish themselves in a space where regulation is slow to move and adapt, these weed growing companies find it very difficult to borrow the money that would normally allow successful businesses to expand and flourish in other industries. In comes Innovative Industrial to provide loans to these weed businesses.

This is the most critical time for successful hemp companies to expand their businesses. If regulation increases, as it is expected to do, the businesses that have the most maturity in this space will have a massive advantage over companies that come later. If regulation decreases, which is not expected, then first mover advantage will position these early companies to build a brand while competition is still low. However, this same early market oppurtunity that these companies have, also means that it has become very hard to raise capital, to borrow money to fund growth during this vital time period. Below is a rather lengthy excerpt from Innovative Industrials 10k which provides an overview of the regulation timeline and why most traditional lending sources such as banks are hesitent to touch marijuana companies. Fair warning, the excerpt is longer than our analysis:

“Cannabis (with the exception of hemp containing no more than 0.3% THC by dry weight)

is illegal under U.S. federal law.

The U.S. federal government regulates drugs through the Controlled Substances Act of 1970 (the “CSA”). The CSA classifies marijuana (cannabis) as a Schedule I controlled substance, and as such, the manufacture, distribution and dispensing of marijuana is illegal under U.S. federal law. Moreover, on two separate occasions the U.S. Supreme Court ruled that the CSA trumps state law.

That means that the federal government may enforce U.S. drug laws against companies operating in accordance with state cannabis laws,

creating a climate of legal uncertainty regarding the production and sale of cannabis. Unless and until Congress amends the CSA with respect to cannabis (and the President approves such amendment), there is a risk that the federal law enforcement authorities responsible for enforcing the CSA, including the U.S. Department of Justice (“DOJ”) and the Drug Enforcement Agency (“DEA”), may enforce current federal law.

Under the Obama administration, the DOJ previously issued memoranda, including the so-called “Cole Memo” on August 29, 2013, providing internal guidance to federal prosecutors concerning enforcement of federal cannabis prohibitions under the CSA. This guidance essentially characterized as inefficient the use of federal law enforcement resources to prosecute those complying with state laws allowing the use, manufacture and distribution of cannabis where states have enacted laws legalizing cannabis in some form and have also implemented strong and effective regulatory and enforcement systems to control the cultivation, processing, distribution, sale and possession of cannabis, conduct in compliance with those laws and regulations was not a priority for the DOJ. Instead,

the Cole Memo directed U.S. Attorney’s Offices discretion not to investigate or prosecute state law compliant participants in the medical cannabis industry who did not implicate one or more specifically identified federal government priorities,

including preventing interstate diversion or distribution of cannabis to minors.

On January 4, 2018, then-U.S.

Attorney General Jeff Sessions issued a written memorandum rescinding the Cole Memo

and related internal guidance issued by the DOJ regarding federal law enforcement priorities involving cannabis (the “Sessions Memo”). The Sessions Memo instructed federal prosecutors to enforce the laws enacted by Congress and to follow well-established principles that govern all federal prosecutors when deciding whether to pursue prosecutions related to cannabis activities. As a result, federal prosecutors could, and still can, use their prosecutorial discretion to decide to prosecute actors compliant with their state laws. The Sessions Memo states that “these principles require federal prosecutors deciding which cases to prosecute to weigh all relevant considerations, including federal law enforcement priorities set by the Attorney General, the seriousness of the crime, the deterrent effect of criminal prosecution, and the cumulative impact of particular crimes on the community.” The Sessions Memo went on to state that given the DOJ’s well-established general principles, “previous nationwide guidance specific to marijuana is unnecessary and is rescinded, effective immediately.” Although there have not been any identified prosecutions of state law compliant cannabis entities, there can be no assurance that the federal government will not enforce federal laws relating to cannabis in the future and it remains unclear what impact the Sessions Memo will have on the regulated cannabis industry, if any.

Jeff Sessions resigned as U.S. Attorney General on November 7, 2018.

On February 14, 2019,

William Barr was confirmed as U.S. Attorney General.

However, in a written response to questions from U.S. Senator Cory Booker made as a nominee,

Attorney General Barr stated “I do not intend to go after parties who have complied with state law in reliance on the Cole Memo.”

The DOJ under Mr. Barr did not take a formal position on federal enforcement of laws relating to cannabis.

Attorney General Merrick Garland, who was confirmed as U.S. Attorney General on March 10, 2021, has not provided a clear policy directive for the United States as it pertains to state-legal cannabis-related activities,

and there can be no assurances that DOJ or other law enforcement authorities will not seek to vigorously enforce current U.S. federal laws.

In August 2023, the U.S. Department of Health and Human Services (“HHS”) recommended to the DEA that cannabis be reclassified from a Schedule I drug to a Schedule III drug under the CSA.

HHS based this recommendation on a Food and Drug Administration (“FDA”) review of cannabis’ classification pursuant to President Biden’s executive order in October 2022. The process for reclassification will require DEA approval and likely complex administrative rulemaking proceedings, and

it remains unclear how long this process will take

and the scope of any final decisions or rules.

One legislative safeguard for the medical cannabis industry, appended to federal appropriations legislation, remains in place. Commonly referred to as the “Rohrabacher-Blumenauer Amendment”, this so-called “rider” provision has been appended to the Consolidated Appropriations Acts since 2015.

Under the terms of the Rohrabacher-Blumenauer rider, the federal government is prohibited from using congressionally appropriated funds to enforce federal cannabis laws against regulated medical cannabis actors operating in compliance with state and local law. In January 2024, a stopgap spending bill passed, extending the application of the Rohrabacher-Blumenauer Amendment until March 8, 2024.

There is no assurance that Congress will approve inclusion of a similar prohibition on DOJ spending in the appropriations bills for future years. In USA vs. McIntosh, the United States Circuit Court of Appeals for the Ninth Circuit held that this provision prohibits the DOJ from spending funds from relevant appropriations acts to prosecute individuals who engage in conduct permitted by state medical-use cannabis laws and who strictly comply with such laws. However, the Ninth Circuit’s opinion, which only applies in the states of Alaska, Arizona, California, Hawaii and Idaho, also held that persons who do not strictly comply with all state laws and regulations regarding the distribution, possession and cultivation of medical-use cannabis have engaged in conduct that is unauthorized, and in such instances the DOJ may prosecute those individuals.

All banks are subject to federal law, whether the bank is a national bank or state-chartered bank. At a minimum, all banks maintain federal deposit insurance which requires adherence to federal law. Violation of federal law could subject a bank to loss of its charter. Financial transactions involving proceeds generated by cannabis-related conduct can form the basis for prosecution under the federal money laundering statutes, unlicensed money transmitter statutes and the Bank Secrecy Act. For example, under the Bank Secrecy Act, banks must report to the federal government any suspected illegal activity, which would include any transaction associated with a cannabis-related business. These reports must be filed even though the business is operating in compliance with applicable state and local laws. Therefore, financial institutions that conduct transactions with money generated by cannabis-related conduct could face criminal liability under the Bank Secrecy Act for, among other things, failing to identify or report financial transactions that involve the proceeds of cannabis-related violations of the CSA.

Despite these laws, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) issued a memorandum on February 14, 2014 (the “FinCEN Memorandum”) outlining the pathways for financial institutions to bank state-sanctioned cannabis businesses in compliance with federal enforcement priorities. Concurrently with the FinCEN Memorandum, the DOJ issued supplemental guidance directing federal prosecutors to consider the federal enforcement priorities enumerated in the Cole Memo with respect to federal anti-money laundering, unlicensed money transmitter and Bank Secrecy Act offenses based on cannabis-related violations of the CSA. The FinCEN Memorandum sets forth extensive requirements for financial institutions to meet if they want to offer bank accounts to cannabis-related businesses and echoed the enforcement priorities of the Cole Memo. Under these guidelines, financial institutions must submit a Suspicious Activity Report (“SAR”) in connection with all cannabis-related banking activities by any client of such financial institution, in accordance with federal anti-money laundering laws. These cannabis-related SARs are divided into three categories – cannabis limited, cannabis priority, and cannabis terminated – based on the financial institution’s belief that the business in question follows state law, is operating outside of compliance with state law, or where the banking relationship has been terminated, respectively. This is a level of scrutiny that is far beyond what is expected of any normal banking relationship.

As a result, many banks are hesitant to offer any banking services to cannabis-related businesses, including opening bank accounts. While we currently maintain banking relationships, our inability to maintain those accounts or the lack of access to bank accounts or other banking services in the future, would make it difficult for us to operate our business, increase our operating costs, and pose additional operational, logistical and security challenges. Similarly, if our proposed tenants are unable to access banking services, they will not be able to enter into triple-net leasing arrangements with us, as our leases will require rent payments to be made by check or wire transfer.

The rescission of the Cole Memo has not yet affected the status of the FinCEN Memorandum, nor has the Department of the Treasury given any indication that it intends to rescind the FinCEN Memorandum itself. Although the FinCEN Memorandum remains intact, it is unclear whether the current administration will continue to follow the guidelines of the FinCEN Memorandum. The DOJ continues to have the right and power to prosecute crimes committed by banks and financial institutions, such as money laundering and violations of the Bank Secrecy Act, that occur in any state including states that have in some form legalized the sale of cannabis. Further, the conduct of the DOJ’s enforcement priorities could change for any number of reasons. A change in the DOJ’s priorities could result in the DOJ’s prosecuting banks and financial institutions for crimes that were not previously prosecuted.

In addition, for our tenants that are publicly traded companies, securities clearing firms may refuse to accept deposits of securities of those tenants, which may negatively impact the trading and valuations of such tenants and have a material adverse impact on our tenants’ ability to finance their operations and growth through the capital markets.

The increased uncertainty surrounding financial transactions related to cannabis activities may also result in financial institutions discontinuing services to the cannabis industry.”

As you can see, these companies appear to be operating illegally. Some of these are even publicly listed such that anyone with a stock broker can buy or sell them. Furthermore, they appear to be operating in the shadow of public statements of intent by those government entities tasked with enforcing the laws that are being broken. Which means it’s no surprise that most of the market isn’t willing to loan money to marijuana companies, especially the largest and most established banks.

Luckily, whoever is behind Innovative Industrial understands the core principal that “everything is debt”. They realized that these weed companies have property, and that having property gives you access to capital. So the way that Innovative Industrial lends these companies money is through the weed growers’ real estate. They buy the property from the weed grower (the loan), and then sell the property back to the tenant via lease payments (loan payments). This enables weed growing companies to leverage their assets (their growing facility) to borrow money to grow and expand. Companies that take advantage of this, arent just growing at an oppurtune time in terms of regulation and competition over the growth and sale of marijuana, they are doing so also at a time when most other marijuana companies have no one to borrow from.

Most interesting about this real estate structure is that the customers they are lending to arent even profitable, as you can see in the below quote from their 10k:

“Many of our tenants have limited histories of operations, and have not yet been profitable, or have been profitable only for a short period of time. For some or all of 2024, we expect that many of our tenants will continue to incur losses as their expenses increase in connection with the expansion of their operations and the current operating environment, and that they have made and will continue to make rent payments to us from proceeds from the sale of the applicable property or cash on hand, and not funds from operations.”

Although this is not stated in their filings from what we can tell, it seems obvious that if they are lending money to companies that don’t make money, then the actual intent is to foreclose on the properties as most of their customers eventually go bankrupt.

The company reported 69 properties in their last 10k (note not 10q). The company has successfully repossessed multiple properties from tenants no longer able to pay within the last couple of years.

Ok, so it sounds like they do have some recorded success for properties where the tenant eventually fails to pay their lease. Hopefully, they can continue this going forward, as it seems like renting commercial properties to companies that don’t make money is one of the most, if not the most, glaring risk to the business model (outside of regulation and the consequences thereof.) Our analysis on such properties however concludes here, and we make no opinion about IIPR’s current property and tenants and their future outlook, such as when tenants might become delinquent or how much those properties could be sold for either presently or in the future. Such a deep and time consuming analysis of value its outside the scope of this brief overview, and should be recognized as an important gap in our perspective.

The best thing about IIPR is that it is structured as a REIT.

What is a REIT?

A REIT, generally, is a company that owns – and typically operates – income-producing real estate or real estate-related assets. The income-producing real estate assets owned by a REIT may include office buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Most REITs specialize in a single type of real estate – for example, apartment communities. There are retail REITs, office REITs, residential REITs, healthcare REITs, and industrial REITs, to name a few. What distinguishes REITs from other real estate companies is that a REIT must acquire and develop its real estate properties primarily to operate them as part of its own investment portfolio, as opposed to reselling those properties after they have been developed.and buy commercial real estate.

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends. A company that qualifies as a REIT is allowed to deduct from its corporate taxable income all of the dividends that it pays out to its shareholders. Because of this special tax treatment, most REITs pay out at least 100 percent of their taxable income to their shareholders and, therefore, owe no corporate tax.

Further reading: https://www.sec.gov/files/reits.pdf

Most of the marijuana companies that the firm has looked at are not profitable and do not pay a dividend. Not only does the structure of a REIT encourage a company to be profitable, it ensures that profits generated by the company are returned to shareholders by taxing any money that isn’t distributed this way. So, finally, let’s look at how much money they make:

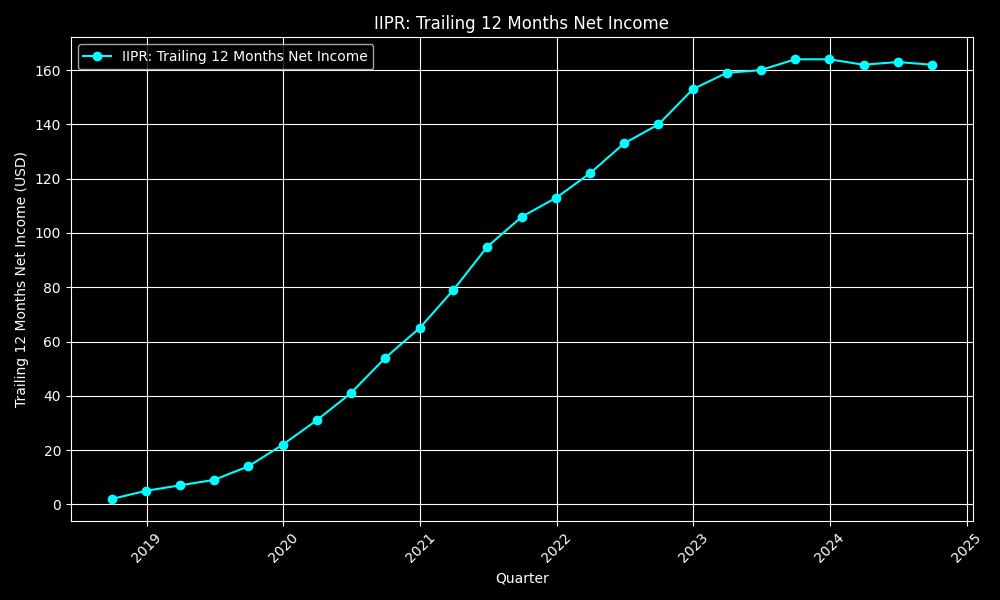

So it looks like revenue and profits are stagnating, with reduced growth in 2023 and no growth in 2024. This reiterates the risk of lower profits for a business that relies on unprofitable tenants.

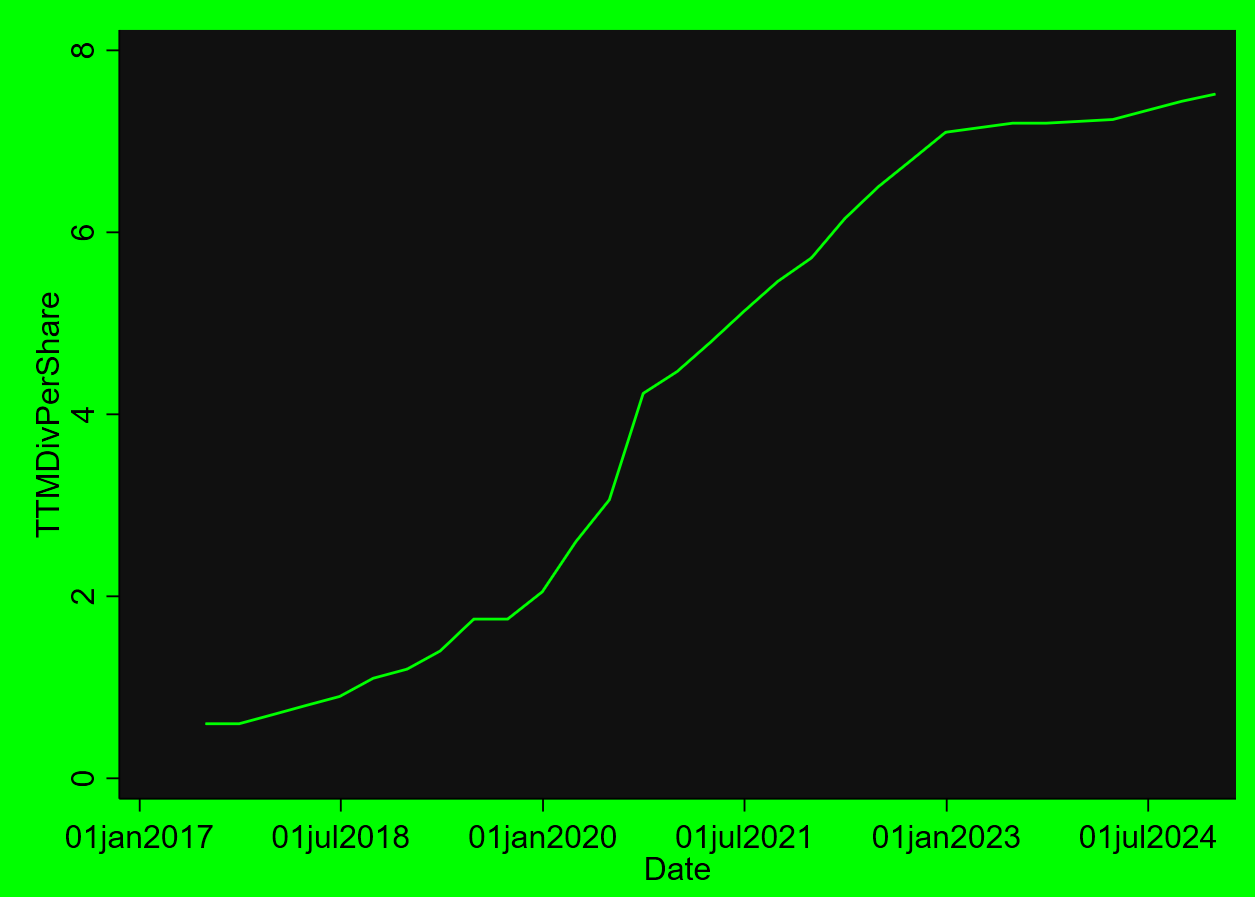

Now to the entire reason this blog has been written- how much they pay their investors. Which as you recall is legally incentivized because of their REIT structure.

The top chart shows the trailing twelve month dividend. As you can see the growth of the dividend is stagnating.

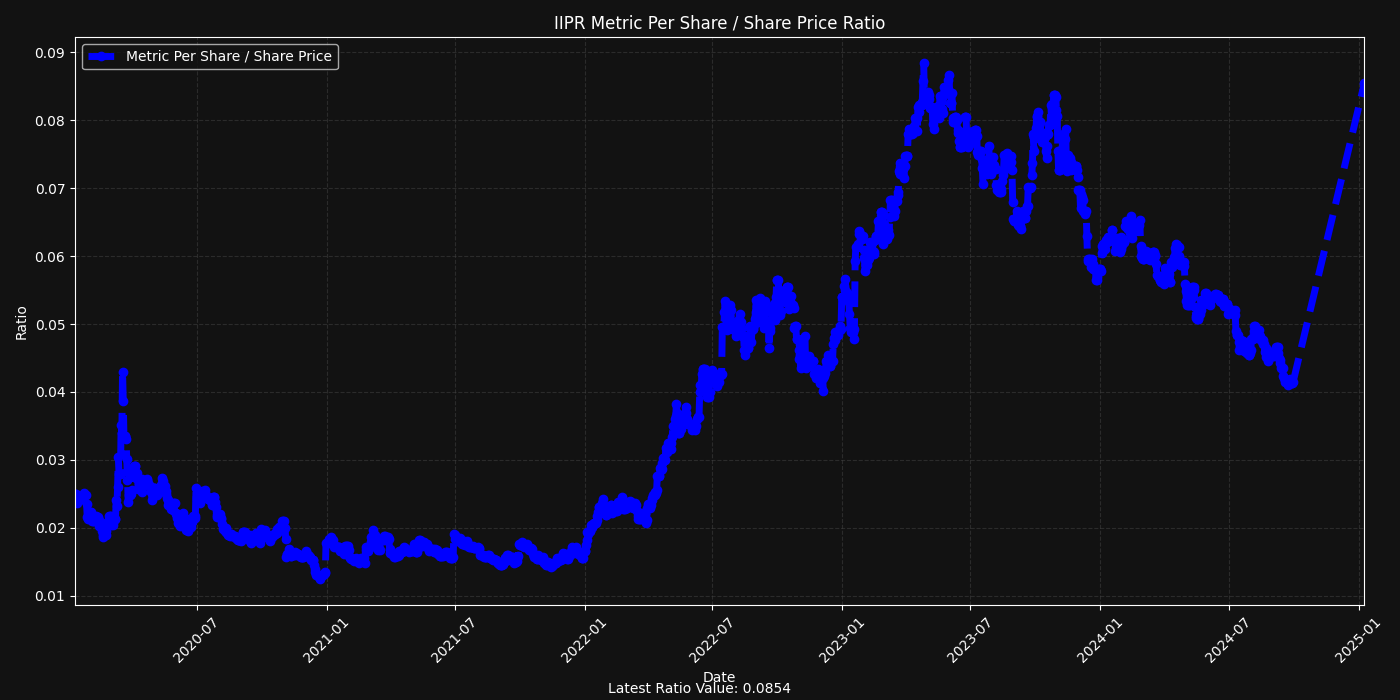

The bottom chart shows company’s earnings per share. As you can see, the value of the shares has shot up recently as the share price has plummeted. It may continue to go up even further (lower share price). The current trailing twelve month dividend is over 11% of the current share price ($7.52 / ~$66).

This is the kind of risk to reward that the firm likes to see. While we certainly can’t tell anyone what to do with their money, it would also be morally wrong to say that this is a great investment when it is not only an illegal investment, but an investment in a company that has hit zero growth this past year and relies on unprofitable tenants.

That said, we like the fact that this company pays its money to its investors and as a result, buying shares in this company at lower and lower share prices will (assuming IIPR continues to make the same amount of money or greater) be rewarded with a higher return. Furthermore, the market may return to previous multiples on the companies earnings, meaning a lower dividend yield, but a higher share price.

In conclusion, the firm believes that this is a stock worth learning more about. Worth doing the math on each of its almost 70 properties. Worth estimating the future success of the business. That the enormous risk presented offers the potential for returns above passive investment, dependent not on market sentiment, but on the actual success or failure of the business. Thank you for your time. #420blazeitfaggot